“ What role does WFM play for shoppers in the future?”

Whole Foods Market -

Executive Research Report

To improve customer satisfaction and expand WFM's business, we conducted customer research and market studies, uncovered pain points, and proposed growth strategies.

Project Type: User Research, IIT ID Team Project

Duration:8 Weeks (Sep 2021- Nov 2021)

My Role: Market Research, Primary Research, Analysis & Synthesis

Location: Chicago

Overview

Whole Foods Market?

Problem:

WFM has grown online and offline since being acquired by Amazon. However, we learned from consumers that WFM is failing to meet the needs of two consumer groups at this stage, Loyalist (quality sensitive) and Optimizer (price-sensitive). Online shopping is unable to meet consumer needs in terms of both service and quality.

Opportunity:

Because of COVID, digital experiences are more critical than ever and offer an opportunity to reach new users (and retain existing ones) through well-considered innovation.

1. Become the industry-leading food delivery app

2. Extend the brand and celebrate local cuisine through delivered meal kits and prepared food

Impact:

Our proposal was chosen by the client as a strategic priority because it successfully combined Amazon's convenience with Whole Foods' quality-focused curation, allowed Amazon to enter an adjacent market space also helped Convince Optimize Customers to purchase a Prime membership.

Research

Market Research -

WFM was no longer the only player in the market.

WFM faced severe competition in organics and was forced to cut costs to survive against mainstream grocers with significant buying power.

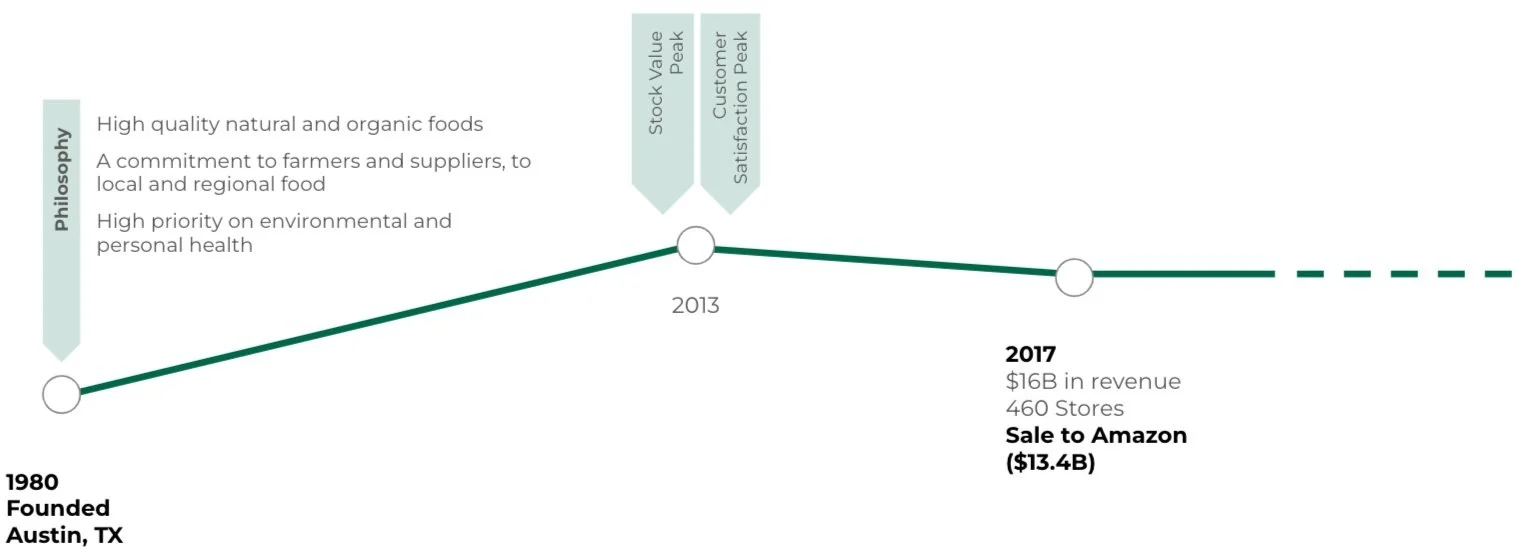

In 2017, The Amazon acquisition changed Whole Foods by mining into Prime members from WFM's customer base, as well as growing online purchases where service and quality cannot be guaranteed, while also impacting the offline shopping experience.

User Research -

WFM is caught between two users

In attempting to appeal to a new shopper (optimizer) that represents a large market, WFM has begun alienating its core user (loyalist).

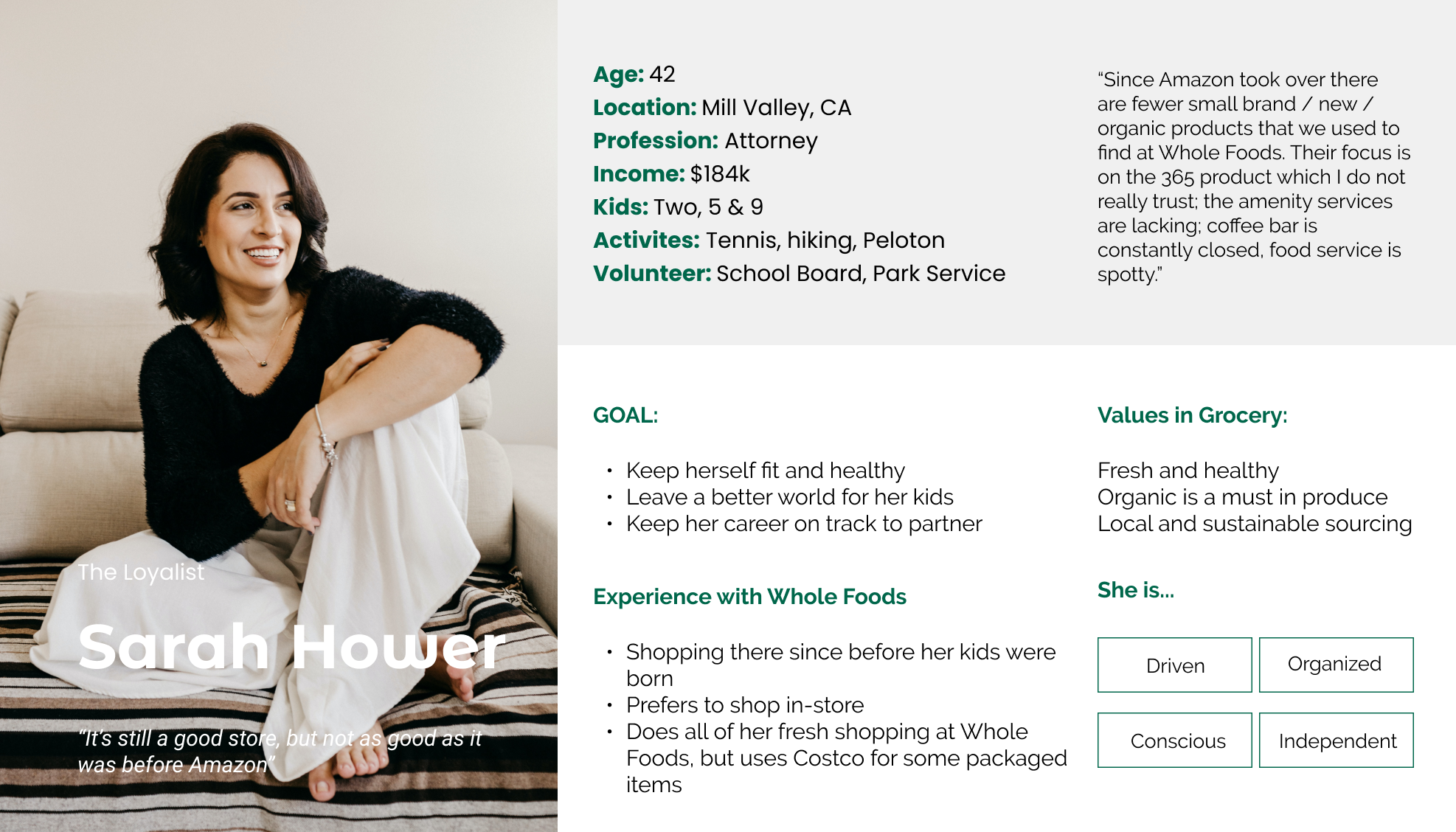

The Loyalist

Major customer but now opt for sophisticated alternatives

From our survey: Loyalist has been shopping at WFM for more than five years and shop at least once a week, almost always in store.

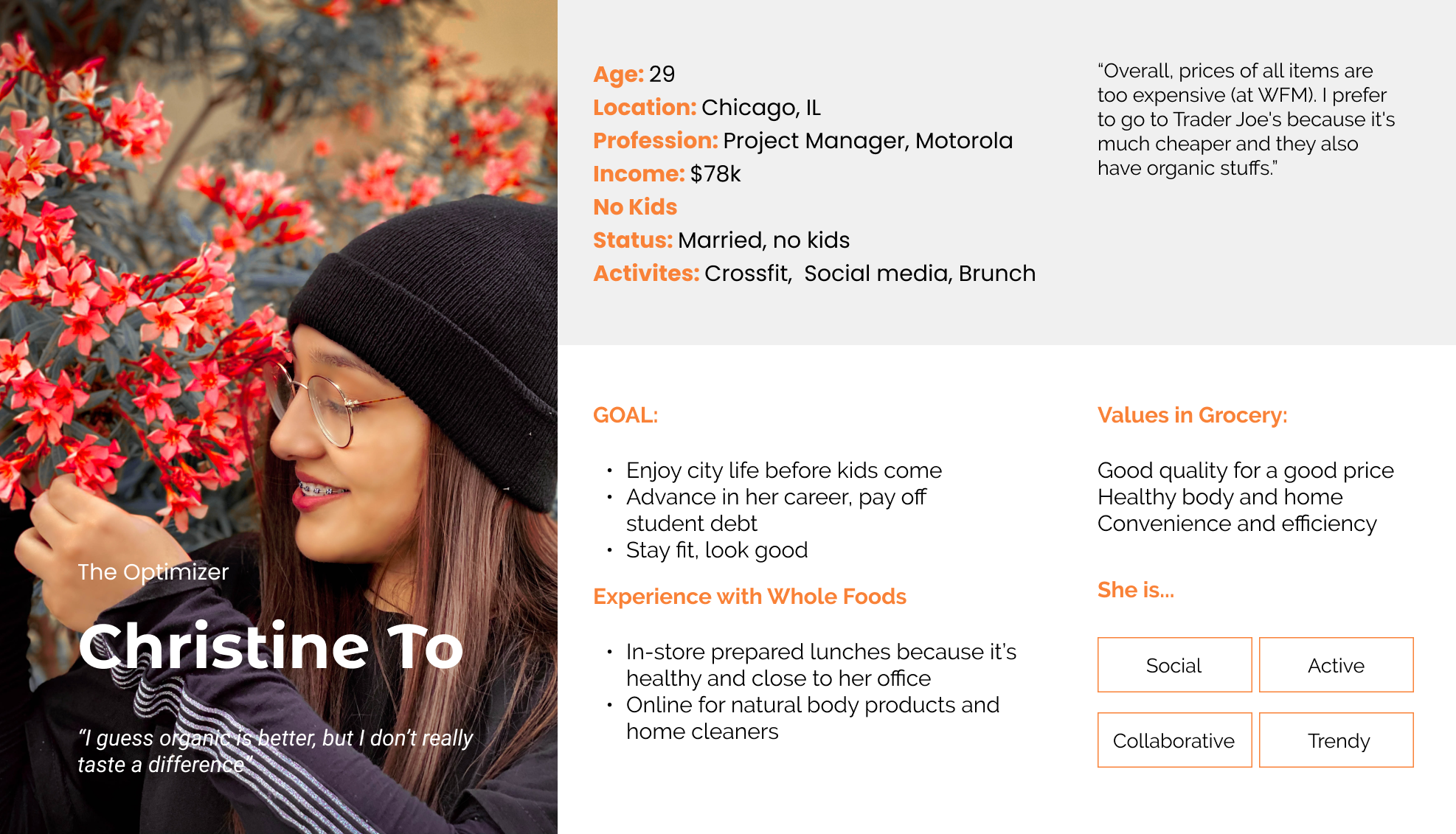

The Optimizer

Price sensitive, brand-agnostic, accessible to all grocery chains

From our survey: Optimizer has been shopping at WFM for less than five years and shops once a month or less, usually using the app.

Fresh food + Online = “White space”

Through the in-home interview and card sorting, we learned that even ardent online shoppers don’t trust online groceries to deliver the best produce and freshest meats and fish, which leads customers to create workarounds for their fresh food.

Therefore, Fresh + Online is an unmet need for users & a potential differentiator for Amazon-Whole Foods.

Trading off quality for longevity

Trading off convenience for trust

Too much is not enough (Selection & Information)

Despite a ton of product selection at WFM online, users are dividing their shop between several retailers; the selection and information in App can be overwhelming and confusing.

Information

Selection

Shoppers with different goals need personalized presentations to help narrow their options, also they are struggling to learn about and compare products online.

Shoppers are overwhelmed by options online but are still dividing their shop amongst several retailers

Based on our research on different customer groups,

we concluded that the future development of Whole Foods Market needs to be properly positioned to deal with different customer groups.

In addition, the online shopping experience is characterized by unclear information and a crisis of trust.

Therefore, in the future development of WFM's strategy,

How might we bring customers more trusting online shopping experiences?

How might we balance the needs of different customer groups?

Strategic Pathfinding

We recommended that Amazon make a clear distinction between grocery sales within its products and the Whole Foods business (which was able to capture the white-space in hyper-local & online fresh produce).

For WFM, we used the Strategy Canvas to articulate the way forward.

Development Strategies

The next goal for WFM is the need to win back quality-focused LOYALISTS, but also include competitive new business units that can attract younger, hard-to-win OPTIMIZERS.

We found the digital and physical shopping experiences to be highly integrated; almost all online shoppers also visit a physical location for some purchases. Understanding how the two formats intersect for users is a key driver of innovation.

Become the industry-leading food delivery app

Extend the brand and celebrate local cuisine through delivered meal kits and prepared food

Opportunity

Making fresh-thru-online feasible

Preserve fresh produce for longer durations, reduce food waste, and thus, better stock & supply them at their larger stores (current WFM or Amazon Fresh) & at “urban corner” WFM stores. This can be reinforced through messaging around Amazon’s proven operational excellence.

Product metadata that inspires trust

Lack of information is a barrier to trust in online purchases. The value lacking is giving adequate knowledge & control over their choices. This could include deeper metadata on selected products, real-time images, or tasting notes. Social proof [real-time reviews from the WFM community] could boost trust too.

Real-time communication with pickers

Users face frustrations in getting the right order without unwanted substitutions as well as needing real-time updates. Streamlining pickup & delivery processes could alleviate key pain points today.

Salad & Hot Bars that come to you

The popular just-cooked meals could benefit young on-the-go workers. This would also lend itself well to a meal subscription service in commercial spots/ office complexes, which could help reframe Prime from ‘discount & offers membership’ to ‘lifestyle benefits club’.